Asymmetric Opportunities Fund June 2023 Update

Dear Investment Partner,

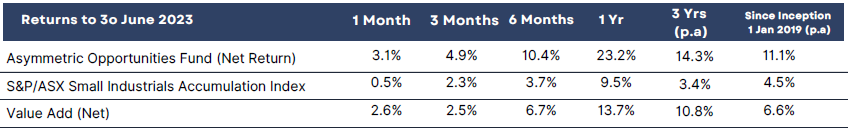

For the month ended 30 June 2023 the Asymmetric Opportunities Fund (AOF) returned 3.1% (net of fees and expenses and assuming the reinvestment of distributions).

By comparison, the fund’s benchmark - the S&P/ASX Small Industrials Accumulation Index - returned 0.5%.

Meanwhile, over the finanical year the fund recorded a gain of 23.2% versus a 9.5% gain by our benchmark. Pleasingly, the fund's performance was also ahead of the S&P/ASX 200 Accumulation Index which returned 14.8% for the financial year.

The closing net asset value (NAV) unit price was $1.16.

Portfolio Update

At month end, the portfolio consisted of 21 companies with a median market capitalisation of $337m.

Driving the fund's return in June was an average share price gain of 16% across our top 5 positions of AUB Group, Codan, Fleetwood, IPD Group and Smartgroup.

Offsetting this was an average 2% decline across the remainder of the portfolio.

The beginning of July has seen us take a stake in fruit and vegetable grower Costa Group after it received a takeover offer from a suitor whom we view as a committed acquirer. We see asymmetry in the return (albeit modest) relative to the risk of non-completion.

Heading into August's reporting season we are comfortable with the portfolio's structure while acutely aware that the past few months will have been tough for many businesses and the outlook statements are likely to be guarded for most companies.

Note that going forward we will be including a 'Fact Sheet' with our monthly updates. This 'Fact Sheet' can be accessed by clicking on the link at the top of this page "Download a PDF of this update".

“May the wind always be at your back”

What experience has taught us

In our weekly Investment Committee meetings, a saying on regular rotation is:

Does this company have the wind in it's back or the wind in its teeth?

Making mistakes or ideally just observing them helps to build a body of investment experiences which guide us as to what works in investing and what doesn't.

One such lesson for us has been to be wary of companies which are facing headwinds in the form of industry demand or dynamics such as competition or regulation. To borrow from Buffett, we prefer to avoid dragons than attempt to slay them.

We don't consider ourself "thematic" investors and our investment process doesn't specifically look to identify trends or themes from a "top-down" perspective. Nonetheless, one criterion for portfolio inclusion is a view that a company will benefit from a tail-wind. Our unitholders have been richly rewarded by our investment in insurance agent and broker, AUB which has benefited from such a tail-wind.

A recent report on the insurance sector by KPMG has highlighted the strong operating environment for insurance brokers. Premiums have been increasing at a double-digit pace but despite these increases, underwriting profitability for insurers remains constrained by soaring claims costs. This situation has resulted in expectations of further premium increases this year (KPMG is forecasting at least 10% in the coming year) with the trend set to continue.

Fund Distributions

Tax rules require a unit trust structure to distribute all taxable profits from a financial year to unitholders. Unitholders will be aware that a resettlement of the trust occured prior to public launch in September 2022. This allowed all capital gains to be realised and all income to be distributed prior to accepting new applications.

No further distribution will be made for the year ending 30 June 2023.

Unlike a company structure, it's not possible to "smooth" distributions within a trust structure. However we would point unitholders to the above table which shows that the forecast yield of the current portfolio is 4.2%.

Fund Applications

Our thanks to all the unitholders who have joined the fund since its public launch on 1 September 2022.

We are always happy to discuss the fund with interested parties so please get in touch with Tim or Pierre if you'd like a presentation on the fund or further information.

We take our roles as stewards of our investment partners' capital very seriously and express our sincere appreciation to you for investing alongside us.

Kind regards,

Tim McArthur & Pierre Prentice

Co-Portfolio Managers

Disclaimer: The information contained in this document is general information only and does not constitute investment or other advice. The contents of this document do not constitute an offer or solicitation to subscribe for units in the Asymmetric Opportunities Fund. Asymmetric Asset Management (AFSL No: 536830) accepts no liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information.